Your credit score is a powerful number that affects your daily life in ways you might not have even imagined. More and more businesses are starting to use your credit score to make decisions about you.

Your score is used to set your interest rates on credit cards and loans, even to decide whether you get approved for those credit cards and loans. Car insurance companies use your credit score to set your rate. Utility companies check your credit score before establishing new service in your name. Even some employers check credit history on which your credit score is based (but not your actual credit score) to decide whether to give a job, a raise, or promotion.

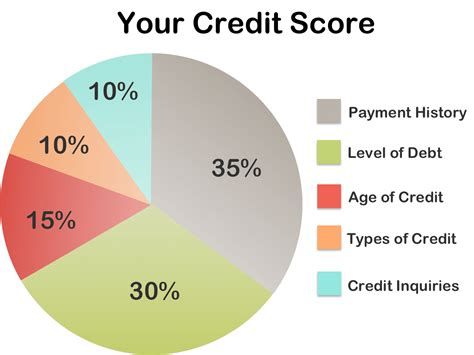

Read on to learn more about the five key factors that influence your credit score.

Your Payment History Affects Your Credit Score

Payment history is 35% of your credit score. How timely you pay your bills affects your credit score more than any other factor. Serious payment issues, like charge-off, collection, bankruptcy, repossession, and foreclosure can devastate your credit score, making it almost impossible to get approved for anything that requires good credit.

The best thing you can do for your credit score is to make your payments on time each month.

Your Level of Debt Affects Your Credit Score

Level of debt is 30% of your credit score. Credit scoring calculations, like the FICO score, look at a few key factors related to your debt: the amount of debt you have overall, the ratio of your credit card balances to your credit limit (also called credit utilization), and the relation of your loan balances to the original loan amount.

Having high balances or too much debt can affect your credit score. The good thing is that your credit score can improve in this area if you pay down your balances.

Your Age of Credit History Affects Your Credit Score

Age of credit is 15% of your credit score and considers both the age of your oldest account and the average age of all your accounts. Having an “older” credit age is better for your credit score because it shows that you have a lot of experience handling credit. Opening new accounts can lower your average credit age. For that reason, it’s typically not a good idea to open several new accounts at once.

Types of Credit You Have Affects Your Credit Score

There are two basic types of credit accounts: revolving accounts and installment loans. Having both types of accounts on your credit report is better for your credit score because it indicates you have experience managing various types of credit. Types of credit is only 10% of your credit score, so not having a certain type of credit, e.g. an installment loan, won’t devastate your credit score.

Credit Inquiries Affect Your Credit Score

Each time you make an application that requires a credit check, an inquiry is placed on your credit report showing that you’ve made a credit-based application. Inquiries is 10% of your credit score. One or two inquiries won’t hurt terribly, but several inquiries, especially within a short period of time can cost tens of points. Keep your applications to a minimum to preserve your credit score.

The good news here is that only inquiries made within the last 12 months are factored into your credit score. Inquiries fall off your credit report after 24 months.

Note that checking your own credit report results in a “soft” inquiry and does not affect your credit score.

Some factors are commonly mistaken as things that influence credit scores, but they actually do not – not directly at least. Certain information like income, bank balances, and employment status can influence your ability to get approved, but they do not factor into your credit score. Age, marital status, and debit/prepaid card usage also do not influence your credit score.

Distressed Properties Solutions Network

The Distressed Properties Solutions Network starts our program with a FREE consultation and Situational Property Analysis. During the consultation we will listen to your goals, help you with the reality of the situation and present you options that are in your best interest and in line with your goals.

We have no interest or financial gain by suggesting one strategy or professional over another, except for your best interest.

Foreclosure is a complicated and emotionally draining process. If you are having trouble with mortgage debt, it’s often best to research many options. Distressed Property Solutions Network has access to a team of professionals that work together to help you.

The Network has a documented record of success in matching owners with professionals that utilize all options and strategies. Our mission to do all that can be done to help you accomplish your desired outcome. Stop a sale, defend a foreclosure, find a way to work it out with the bank, short sell or bankruptcy as a last resort. Our team looks at each file as a long term process, and advocates credit repair and rebuilding from day one. You CAN apply for a mortgage with our mortgage partners one day out of foreclosure or short sale. So preemptive work is always in the works if that is the direction you want to go in.

Call for a NO COST in depth review of your situation. The networks legal partners are available to you on the first call ready to work with you immediately.

Local: (847) 543-0202

Toll free: (800) 859-1255