IRS, State, & Other Liens Waived

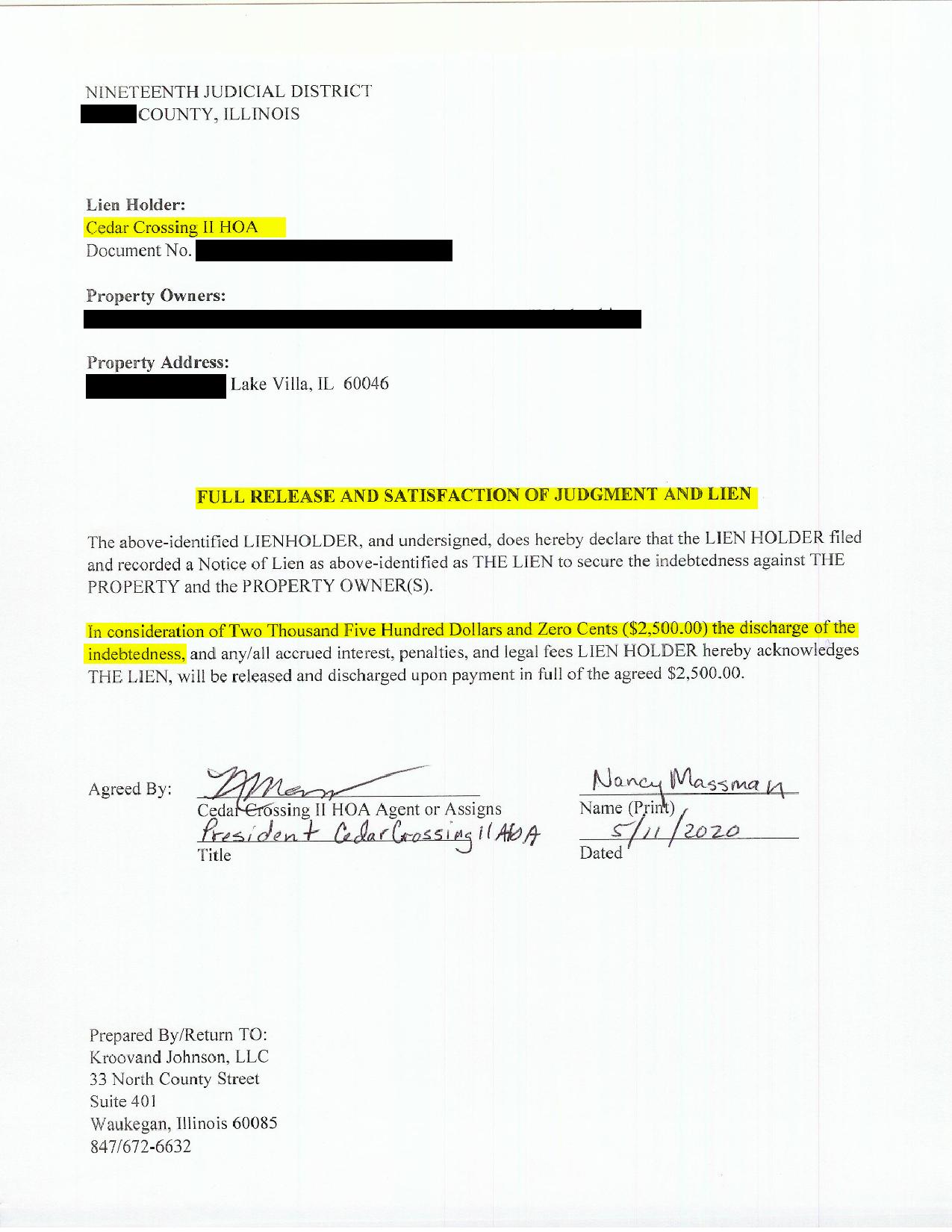

Homeowners Association Fees grew to $6,819 The Primary Mortgage – 1st Mortgage paid them after they were settled for $2,500

-

Approved Property Lien Release

Lender: HOA-Homeowners Association Cedar Crossing II HOA -

Satisfaction of Judgment and Lien

-

The beginning balance past due to HOA was $2,100 by the time our short sale team was engaged it had grown to $6,819. The negotiators struck a deal with Wells Fargo to pay the judgment as part of the short sale approval.

Association Fees past due: $6,819 Primary Mortgage Wells Fargo Paid off

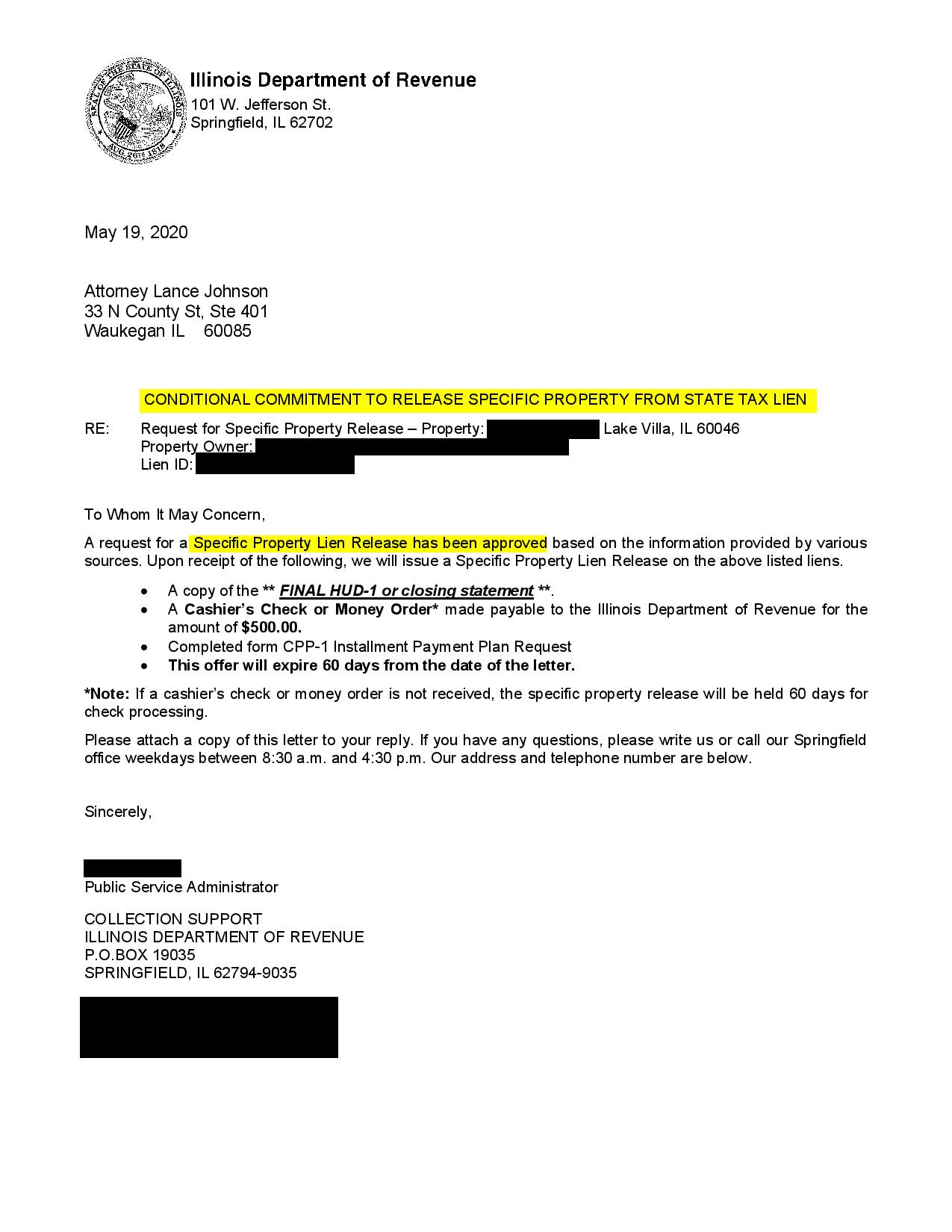

State Income Taxes attached to home as a property lien for a total of $29,488 waived for $500

-

Approved State of Illinois Income Taxes

Lender: State of Illinois Department of Revenue -

State Collections Release

-

After closing their construction business and on disability, this owner never thought he could get out of the back-income taxes he owed the state of Illinois. Underwater on the house by over $100,000 and not able to afford payments short selling the home wiped out all of their outstanding debts.

State of Illinois Taxes: $29,488 State Settled for : $3,100

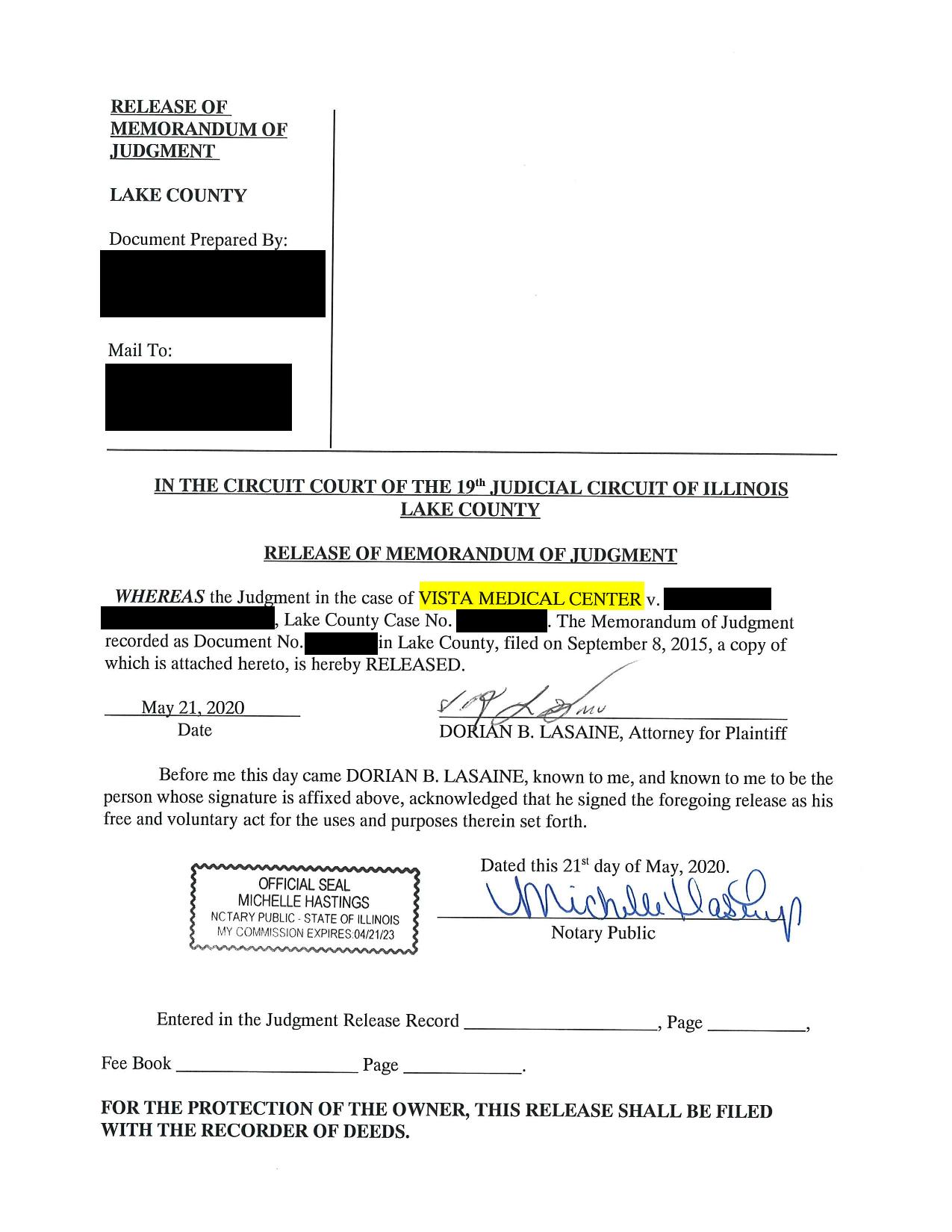

$11,362 Vista Medical Center Lien on Property Released in full after 5 years

-

Approved MEDICAL Lien Release

Lender: Vista Medical Center Illinois -

Medical Bill on Property

-

In 2015 this gentleman became ill and lost his business. The medical bills were placed on his residence as a property lien. The attorney he hired couldn’t get them to settled. Our short sale team was able to have the entire $11,362 released for $500

Debt Settlement for Dr. Bills Settled for $500 for $11,362 bill

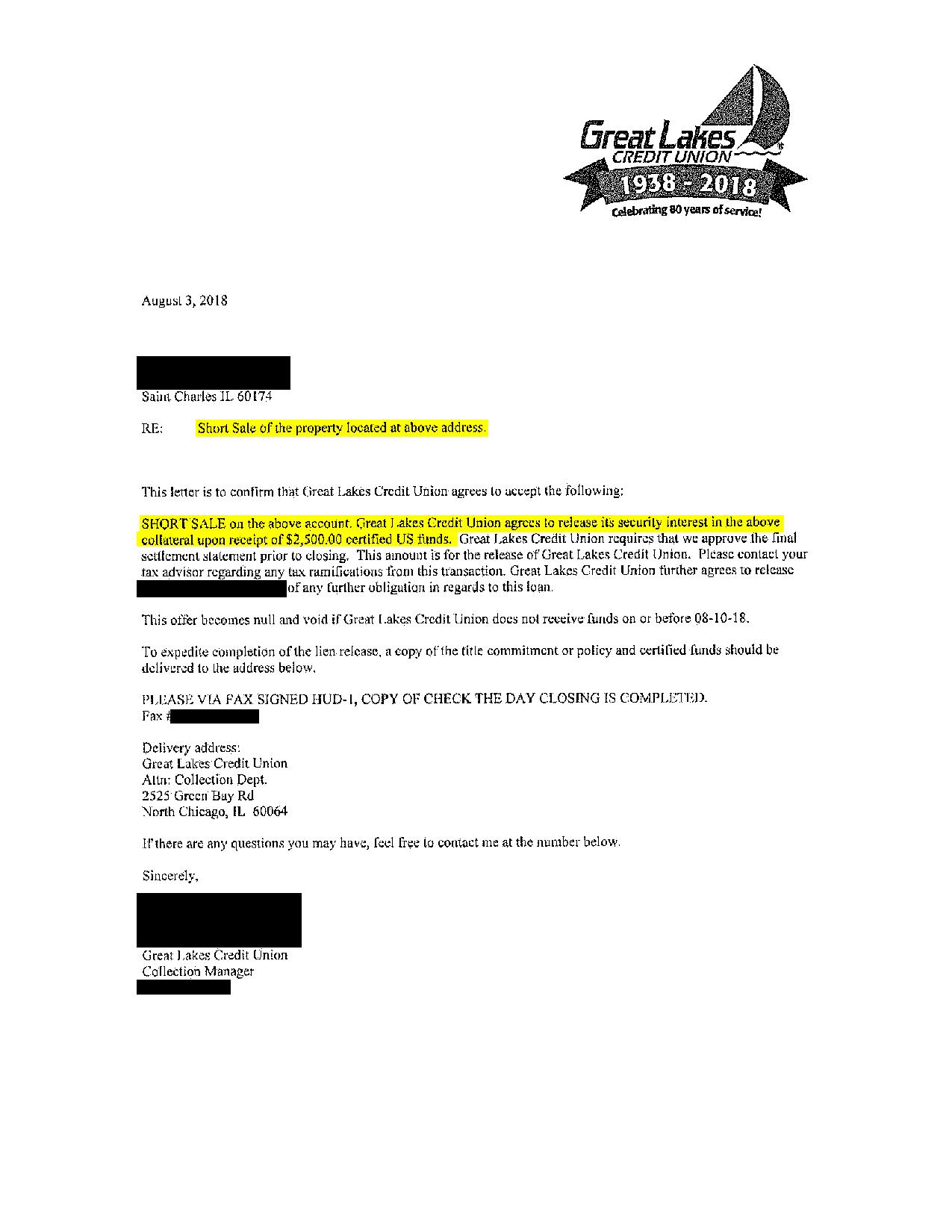

Personal unpaid loan became a lien against the property for $61,430 and was settled for $0.00

-

Approved Personal Loan Lien Release

Lender: Great Lakes Credit Union -

Credit Union Lien on Property

-

Before divorcing this couple took a personal loan with their credit union and never made one payment. Great Lakes Credit Union realized that they would never get payment so released the entire lien upon our teams closing of the short sale.

Personal Judgement placed on property. $61,430 in personal debt waived

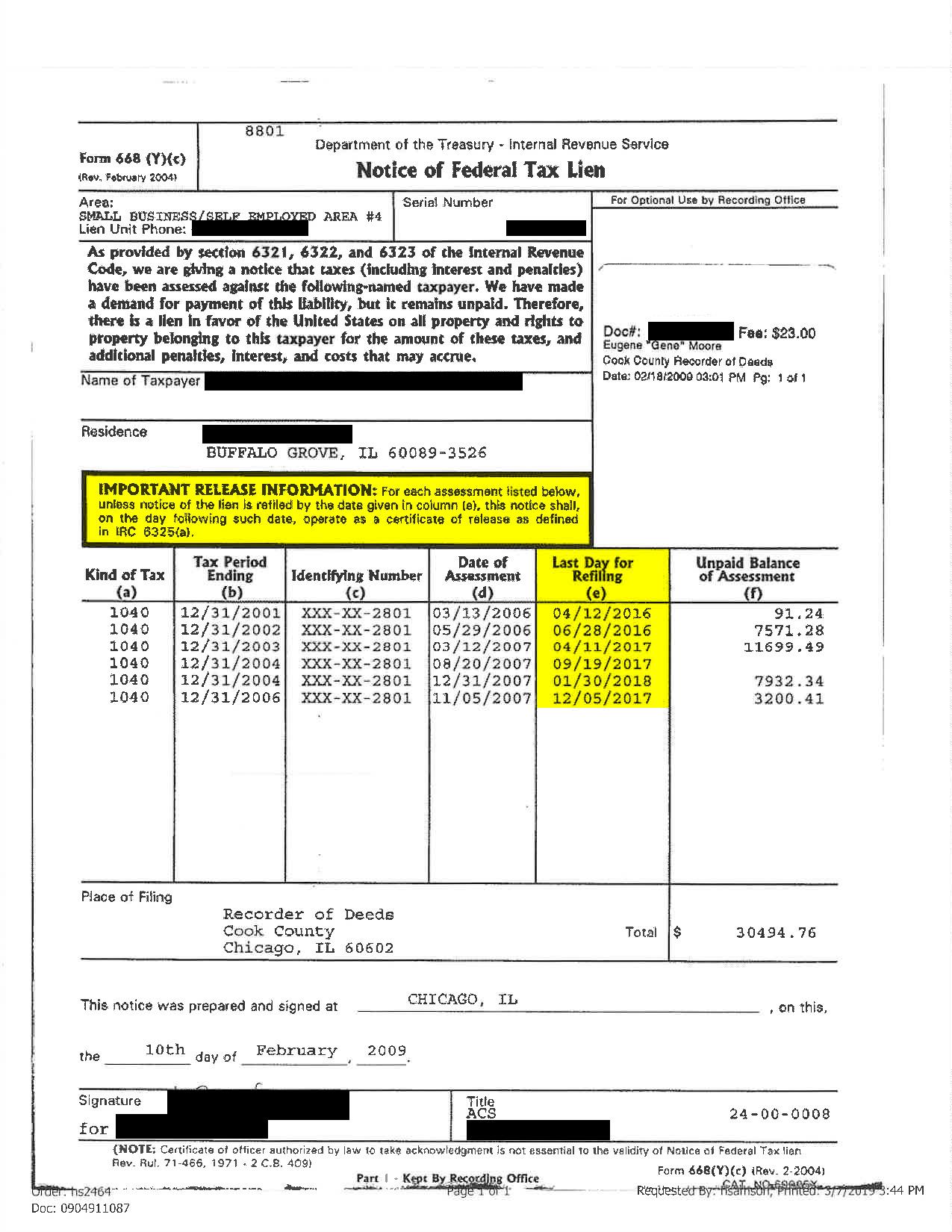

$30,494.76 in IRS – Federal Tax Liens forgiven with the short sale of property

-

Approved IRS Lien Release

Lender: Department of Treasury – Internal Revenue Service -

Federal Tax Lien on Property

-

This couple became disabled in a car accident and thought they would never get out of the Department of Treasury chasing them. Their house sold as a tear down with very little value and our team was able to negotiate the 6 liens away for $0.00

IRS Liens released upon closing of short sale

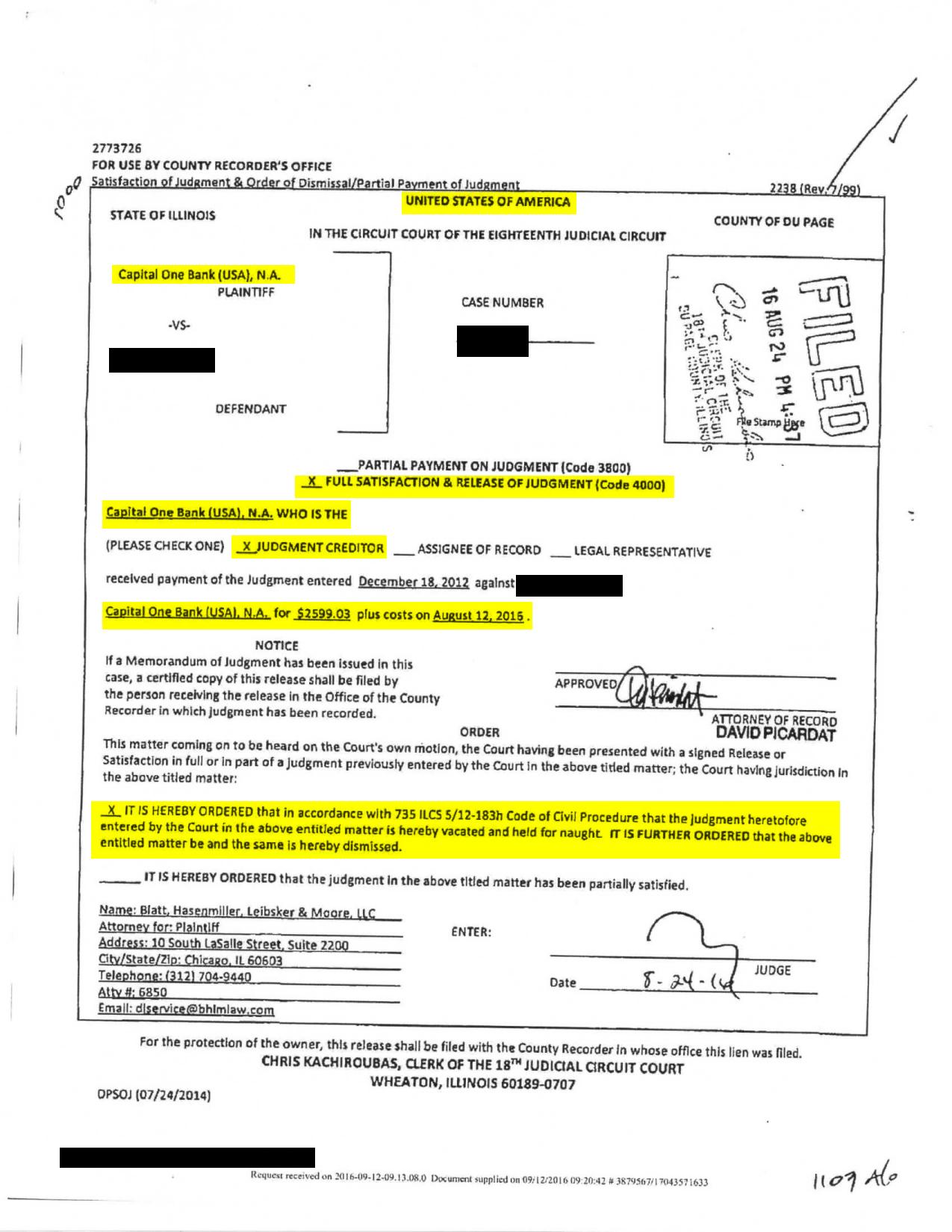

Capital One Credit Card sued, won and put a judgment on the property for $2,599.09

-

Approved Property Lien Release

Lender: Capital One Bank (USA) -

Satisfaction of Judgment and Lien

-

Yes credit cards can win a judgment and place it on your property-home and then wait to collect when selling or refinancing. The debt won’t just go away. Because this was a short sale negotiation we were able to have it included and paid by mortgage.

Credit Card Property Lien – Paid in Full by Mortgage

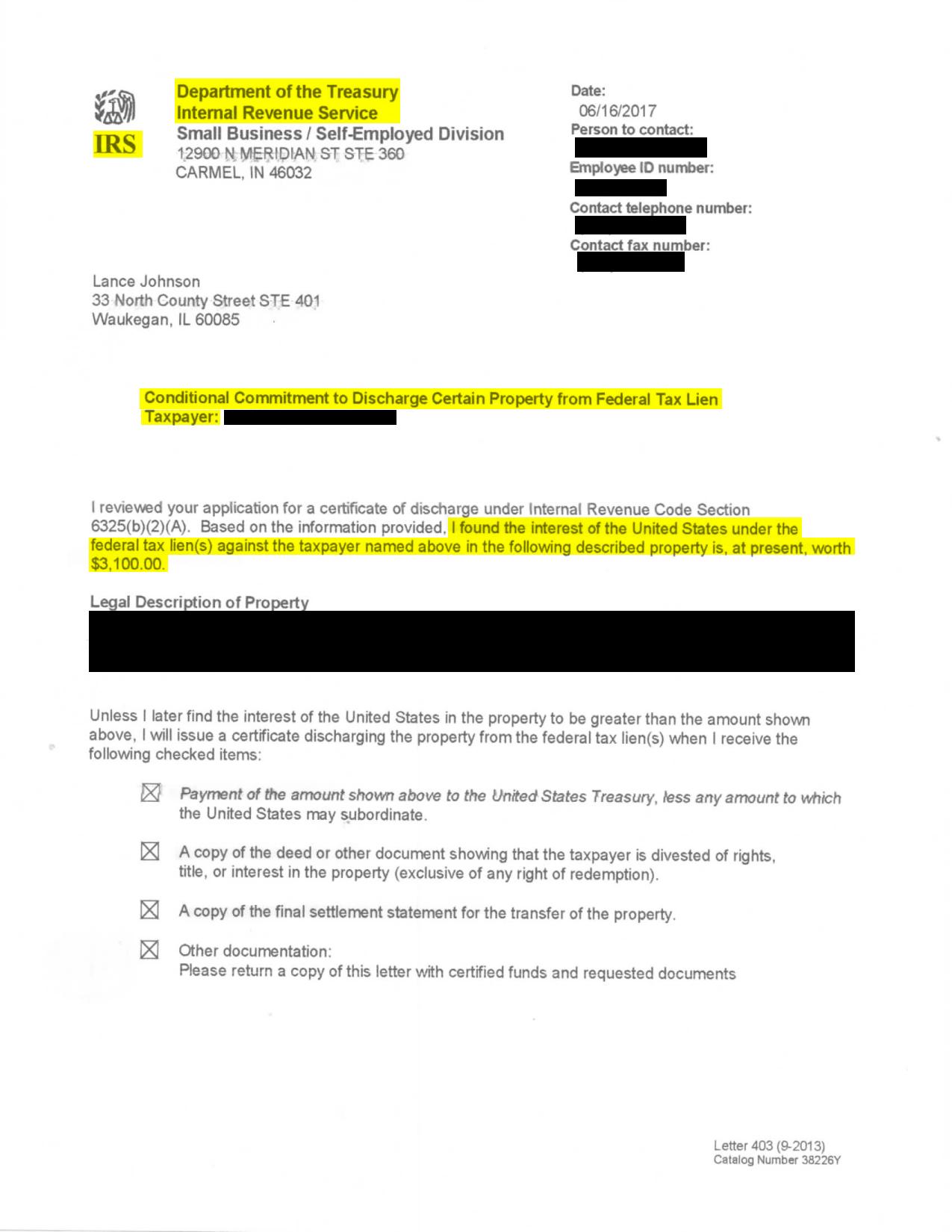

Owing the IRS $103,885 and settling it for the remaining profit from the sale of their home for $3,100 changed this retired couples’ lives

-

Approved IRS Release

Lender: Department of Treasury Small Business / Self-Employed Divsion -

Small Business/Self Employed Release

-

This couple was told by attorneys, realtors, and accountants that they could never sell their house because the IRS would never agree to a settlement. Our team brought in real estate, tax and bankruptcy attorneys and our real estate division. They started their retirement off not owing anything.

Federal Taxes Owed: $103,885 IRS Accepted Agreement: $3,100